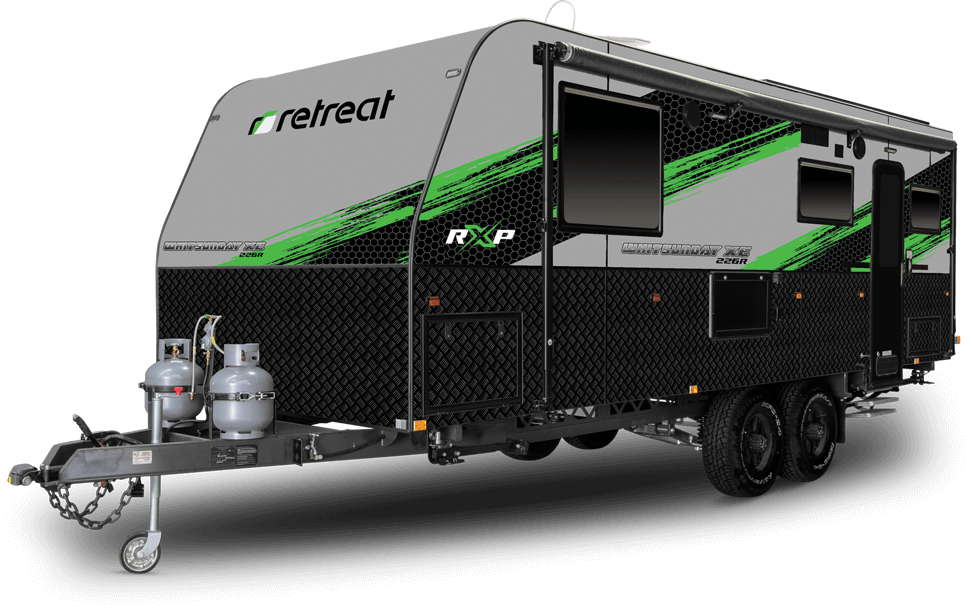

Introducing the

2024 off-grid range

When our customers purchase a Retreat, they aren’t just purchasing a caravan. A Retreat caravan is about living a certain lifestyle, travelling with old friends, meeting new friends on the road or at our rallies, enjoying each other’s company, and raising money for important charities like the Cancer Council.